The growth of corporate activism on contentious social issues creates a puzzle as to why companies would risk engaging on divisive topics. While corporations often decide not to weigh in on social and political issues as a way to remain neutral or believing that it is not their place to weigh in on issues unrelated to their products and services, such silence can be viewed negatively by their customers. For example, it is not uncommon to see negative consumer comments on brands’ social media such as the comments below on Uniqlo’s Instagram post during Black Lives Matter’s protest of police brutality in the United States. [See more examples at the bottom of the web appendix here]

My lasted publication (SSRN version) with Marco Qin, Xueming Luo, and Todd Scheiffling entitled, “When corporate silence is costly: Negative Consumer Responses to Corporate Silence on Social Issues,” sheds light on this phenomenon by estimating the consequences of not engaging in corporate activism. Grounded in the cognitive model of stakeholder behavior, we theorize whether and when consumers will negatively respond to corporate silence on a social issue based on the visibility of silence. While peer firms’ activism increases negative reactions to corporate silence by making it easier to notice a focal firm’s silence and to assess it as a deliberate choice, a narrow market niche mitigates negative reactions to corporate silence by decreasing the visibility of firm behavior compared with mass market firms.

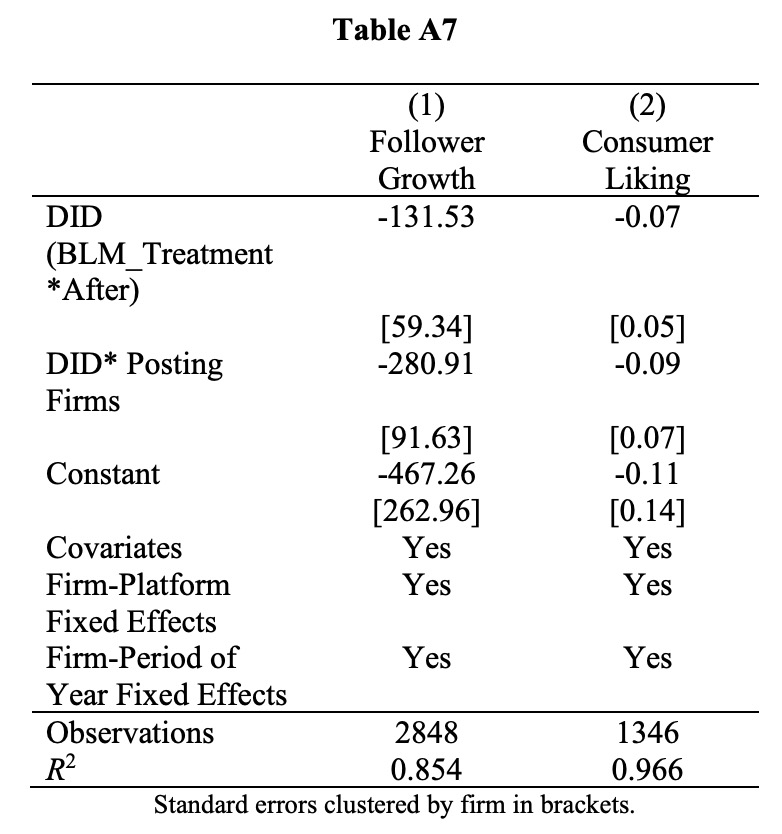

We study stakeholder responses to corporate silence in the empirical context of fashion firms and the Blackout Tuesday event in support of the Black Lives Matter movement, which occurred on Instagram but not Twitter. Using a within-company cross-platform difference-in-differences econometric model, we find support for our theory and uncover substantial costs of corporate inaction. Our key results suggest:

- For firms that do not participate in the event, follower growth slows 33% and likes on their posts drop 12% in the following month on Instagram as compared to Twitter.

- The negative effects are attenuated when close rivals of the focal firm are also non-participants.

- The consequences of silence only pertains to mass-market firms.

Data and Method. We collect data for 312 major national firms surrounding the natural experiment of BLM’s Blackout Tuesday event. This event originated on June 1, 2020, under the hashtag #TheShowMustBePaused. Word of the event quickly went viral, taking on its own identity under the #BlackoutTuesday hashtag on Instagram. On June 2, 2020, BLM supporters, including many firms from the fashion industry, posted black squares on their Instagram feeds to crowd out other content to highlight the issues of racial justice and police brutality. Our data come from two main sources, Instagram and Twitter. For each post, we collect the text content, time stamp, and total like counts. From a third-party tracking website, Socialblade.com, we also collect each firm’s daily total follower counts for each platform. Across the 312 fashion brands, 178 firms stayed silent on Instagram and Twitter during the event and 174 participated in Blackout Tuesday only on Instagram and not Twitter.

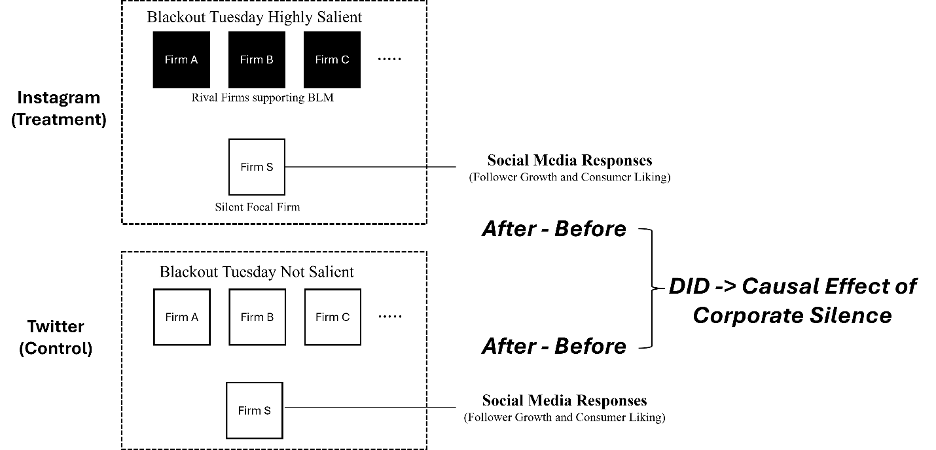

The treatment we want to study can be visualized as below. On Instagram, the silent firms appear in users’ feed alongside other firms’ Blackout Tuesday content. On Twitter, the same firm does not appear alongside other firms’ Blackout Tuesday content. Therefore, we apply a difference-in-differences approach to study how the same firm’s follower growth and post-liking changes after vs. before Blackout Tuesday on Instagram (treatment) vs. Twitter (control).

Additionally, we test how the effect of peer firms’ corporate activism my bifurcate the result of silence. The illustration below highlights how peer-activism might lead to different consumer interactions with the focal silent brand.

We visualize the main empirical patterns that drive the econometric results below. The pattern shows that Instagram follower growth and content likes (in green) both decline sharply in the week following Blackout Tuesday before recovering towards normal levels while the same accounts on Twitter do not experience a parallel shock.

One concern for this result is that the decreasing trend in follower growth and likes is simply an artifact of Instagram de-prioritizing visibility of accounts. We address this concern by testing whether the negative effect is larger among brands that posted recently. The argument is that there are two possible mechanisms have the opposite prediction regarding which group would have a more negative effect. If the negative treatment effect was mainly driven by less attention due to platform design factors, then we should expect the effect to be more negative for those who haven’t posted anything 3 days before the event. This is because, compared with the other group, they have even less exposure on the social media platform. On the other hand, however, if our mechanism is correct, then we should expect the effect

to be more negative for those firms who posted just days before the event. This is because the

posts make their silence on BLM more salient, which in turn invites more negative responses

from customers. Unfollowing most likely occurs as users interact with an account’s content when

scrolling through their feed. If the firm is not in a customer’s feed to begin with, the unfollowing

effect should be smaller or negligible. The results, reproduced below, is consistent with the latter mechanism.

Beyond the cross-platform DID, our paper involves many interesting methodological contributions. These include applications of GAN-BERT to identify posting content, Doc2Vec for identifying market competition structure from social media content, and use of Google Trend’s “also searched” functionality to identify market competition structure.